Crypto Investing Strategies: A Comprehensive Guide for Smart Investment Decisions

In the rapidly evolving world of cryptocurrency, understanding effective crypto investing strategies is essential for investors looking to maximize their returns while managing risks. With the decentralized nature of the crypto market, coupled with its volatility, creating a solid cryptocurrency investment strategy is crucial for anyone who wants to succeed in this space.

This article will explore different crypto investing strategies, examine key tactics for maximizing your returns, and offer insights into various cryptocurrency market investment strategies that are being employed by successful crypto investors. By the end of this guide, you will have a deeper understanding of how to approach investing in cryptocurrency in a way that aligns with your financial goals.

Understanding Crypto Investing Strategies

What Are Crypto Investing Strategies?

Crypto investing strategies are carefully crafted plans that aim to optimize investment outcomes by focusing on the long-term or short-term objectives of an investor. Unlike traditional investments, cryptocurrencies come with high volatility, making strategic planning all the more essential. A cryptocurrency investment strategy typically involves deciding on the amount of risk an investor is willing to take, the specific cryptocurrencies they wish to invest in, and the timeframe for their investments.

There are several different approaches to crypto investment, depending on market conditions, the investor’s risk tolerance, and their long-term financial goals. Some investors prefer aggressive, short-term trading tactics, while others opt for a more conservative approach, purchasing digital assets and holding them for extended periods.

Long-Term vs. Short-Term Crypto Investing Strategies

One of the fundamental decisions when developing your crypto strategy is whether to focus on long-term investments or engage in short-term trading.

Long-Term Crypto Investing Strategies

Long-term crypto investing strategies focus on buying and holding assets over a prolonged period. Investors who use this approach often have faith in the long-term growth of the cryptocurrency market and believe that digital currencies like Bitcoin, Ethereum, and other established altcoins will appreciate significantly in the coming years.

This cryptocurrency investment strategy involves purchasing assets at relatively low prices and holding them through market fluctuations, anticipating that their value will rise over time. For instance, many investors have built substantial portfolios by holding major cryptocurrencies for several years, despite market volatility.

The main benefits of long-term investing in cryptocurrency include:

- Reduced Frequency of Trading: Long-term investors generally avoid frequent trading, focusing on accumulating assets and benefiting from capital appreciation.

- Lower Stress: Since long-term investors are less concerned with short-term price movements, this strategy is less stressful than day trading.

- Potential for High Returns: Holding assets over time can result in significant capital gains, especially in a bullish crypto market.

Short-Term Crypto Investing Strategies

On the other hand, short-term cryptocurrency market investment strategies focus on quickly buying and selling cryptocurrencies to capitalize on short-term price fluctuations. This strategy is more active and requires a keen understanding of the market, technical analysis, and news events that could trigger price movements.

Diversification: A Key Element in Crypto Investing Strategies

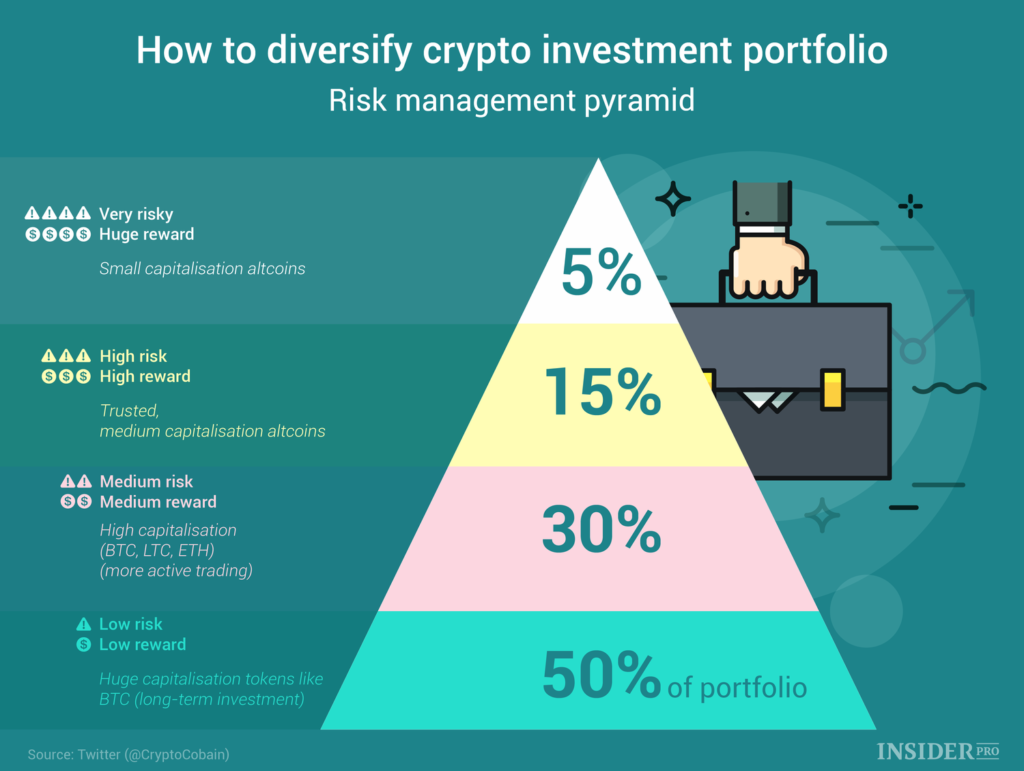

Another crucial aspect of crypto investing strategies is diversification. Diversifying your portfolio across different types of cryptocurrencies reduces the risk of investing in a single asset. Given the high volatility of the crypto market, investing in a variety of cryptocurrencies—whether established coins or smaller altcoins—can help mitigate potential losses.

For example, diversifying between Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and promising smaller altcoins allows investors to spread risk while tapping into different sectors within the crypto space. Diversification helps in balancing the performance of the portfolio, so if one asset experiences a downturn, the others might remain steady or even grow.

Key Benefits of Diversification in Crypto Investments:

- Risk Mitigation: A diversified portfolio reduces the risk of suffering significant losses from the poor performance of a single cryptocurrency.

- Exposure to Emerging Opportunities: Small cap altcoins or emerging coins might deliver higher returns, and diversification provides exposure to those opportunities.

- Stability: A diversified portfolio often experiences less volatility than a concentrated portfolio focused on a few assets.

Risk Management in Crypto Investing

Setting Risk Tolerance Levels

One of the most important aspects of developing a cryptocurrency investment strategy is understanding and setting your risk tolerance. The cryptocurrency market is notorious for its volatility, with prices often swinging dramatically in short periods. As such, it is essential for investors to define their risk tolerance and align their investments accordingly.

Some investors prefer to take on higher risk by investing in newer altcoins with low market caps, while others stick to more established cryptocurrencies like Bitcoin and Ethereum, which are considered relatively stable in the volatile crypto market. Deciding your risk level involves answering questions like:

- How much are you willing to lose if your investment doesn’t perform well?

- Are you ready for the extreme volatility that comes with cryptocurrency trading?

- Do you prefer a more stable, long-term investment strategy, or do you thrive on the excitement of trading small-cap altcoins?

The Importance of Stop-Loss Orders

To protect your investments from severe losses, it is essential to implement stop-loss orders. A stop-loss order automatically sells a cryptocurrency when its price drops to a certain level, effectively minimizing your losses in case the market moves unfavorably.

In the fast-moving world of cryptocurrencies, stop-loss orders are particularly important as they can help you manage risk without having to constantly monitor the market.

Dollar-Cost Averaging: A Smart Crypto Investment Strategy

One of the most popular strategies employed by seasoned investors is dollar-cost averaging (DCA). This strategy involves investing a fixed amount in a cryptocurrency at regular intervals, regardless of its price. Over time, DCA helps reduce the impact of market volatility by averaging the price at which you purchase the asset.

By using DCA, you avoid trying to time the market, which is particularly difficult with the unpredictable nature of cryptocurrencies. Instead, you focus on consistent, long-term investment.

Keeping Up With Crypto Market Trends

Staying informed about the latest developments in the cryptocurrency market is essential for any investor. New trends, government regulations, technological advancements, and market conditions can all affect the performance of cryptocurrencies.

Subscribing to crypto news outlets, joining online forums, and following influencers or analysts can help you stay up-to-date. Platforms like CoinMarketCap provide valuable insights into the latest cryptocurrency market investment strategies and trends, giving you the information you need to make informed decisions.

Additionally, cryptocurrency investment strategy discussions on social media platforms like Reddit, Twitter, and Telegram can offer real-time insights from experienced traders.

Cryptocurrency Investment Strategies for Different Risk Profiles

Not all investors approach crypto with the same level of risk tolerance. Therefore, crypto investing strategies can vary significantly based on the investor’s individual preferences and risk appetite.

Conservative Approach

A conservative crypto investment strategy focuses on low-risk, long-term investments. Investors following this strategy may favor large, established cryptocurrencies with relatively low volatility, such as Bitcoin and Ethereum. This approach seeks steady, moderate returns with minimal exposure to market fluctuations.

Aggressive Approach

An aggressive strategy targets high-risk, high-reward investments, often involving smaller altcoins or emerging cryptocurrencies. Investors willing to take on greater risk in hopes of earning substantial returns might gravitate toward altcoins with low market caps, micro-cap cryptocurrencies, or speculative coins.

Balanced Approach

A balanced approach to crypto investment aims to achieve a compromise between risk and reward. Investors using this strategy may allocate portions of their portfolio to stable coins, large-cap coins like Bitcoin, and smaller, high-potential altcoins to balance growth potential and risk.

Conclusion: Crafting Your Own Crypto Investment Strategy

Effective crypto investing strategies are built on sound research, risk management, and long-term commitment. While the cryptocurrency market is volatile and unpredictable, following a well-thought-out cryptocurrency investment strategy can improve your chances of success. Diversifying your portfolio, employing risk management tactics like stop-loss orders, and staying informed about market trends are key elements of a solid crypto investment approach.

For further reading on how to invest in cryptocurrencies, you can explore this comprehensive guide on Investopedia: Investing in Crypto.

By considering your risk tolerance, determining your investment goals, and adjusting your strategy as market conditions evolve, you can maximize your potential for success in the crypto space.